HR117-1 2005-2026 free printable template

Show details

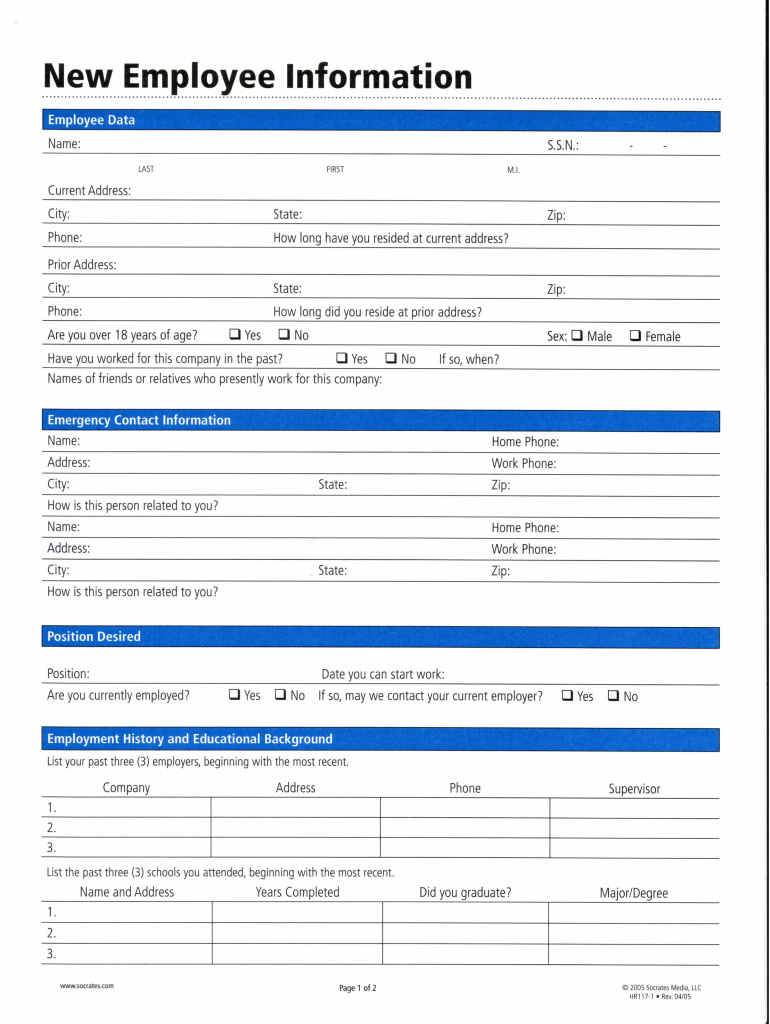

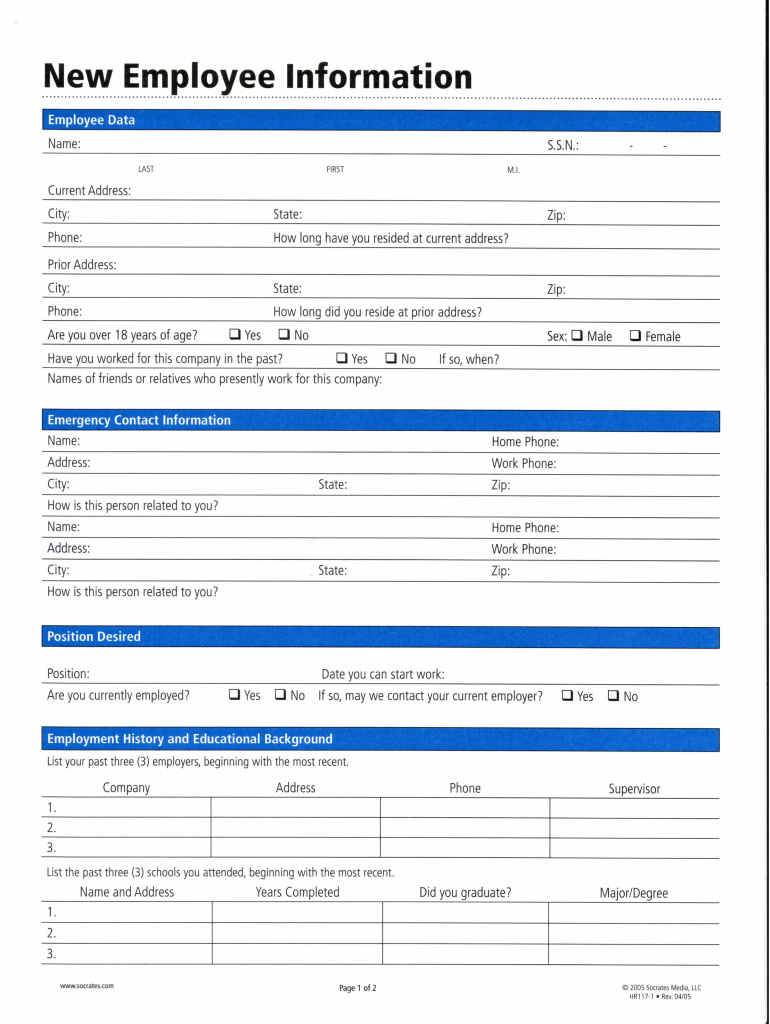

Zip: Phone: How long did you reside at prior address? Are you over 18 years of age? ... 1. 2. 3. Page 1 of 2. O 2005 Socrates Media. LLC. HR117-1 Rev. 04/05 ... I certify that the facts contained

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new hire paperwork form

Edit your new hire form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new hire forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new employee form online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new hire paperwork printable pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

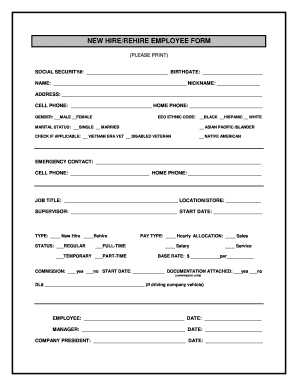

How to fill out employee hiring forms

How to fill out HR117-1

01

Gather all relevant personal and employment information.

02

Start with filling out your full name and contact details at the top of the form.

03

Provide your Social Security Number in the designated section.

04

Indicate your current job title and department.

05

Complete the sections regarding your employment history, including past positions and dates of employment.

06

If applicable, fill out any sections related to benefits or compensation.

07

Review all information for accuracy and completeness before submission.

08

Sign and date the form as required.

Who needs HR117-1?

01

HR117-1 is needed by employees applying for specific benefits or employment verification.

02

It is also required by the HR department to process payroll or benefits administration.

03

Managers and supervisors may need this form to document personnel changes.

Fill

new hire information sheet

: Try Risk Free

People Also Ask about new employee paperwork

What forms do I need from a new employee?

Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

What forms do new employees need to fill out in MN?

Requirements for New Employees To know how much federal and state income tax to withhold from employee wages, you will need both a federal Form W-4 and Minnesota Form W-4MN for each employee. Ask all new employees to complete both the federal and state forms before they begin working.

What two forms must a new employee complete before receiving a paycheck?

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

What paperwork is required for onboarding?

The most important forms that new hires need to fill out include Form W-4 for tax withholding, Form I-9 for employment eligibility verification, and any employer-specific forms for benefits enrollment, direct deposit setup, and emergency contacts.

What two forms must an employee complete?

The new employee must provide documentation of identity and work eligibility.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the printable new hire forms in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your new employee application form in seconds.

How do I fill out the new hire employee forms form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign new hire form pdf and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit printable new hire paperwork on an Android device?

You can edit, sign, and distribute employee forms for new hire on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

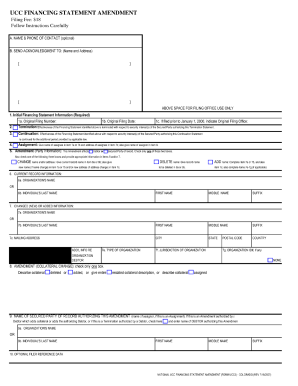

What is HR117-1?

HR117-1 is a specific form or document used for reporting certain information in a defined context, often related to regulatory compliance or financial disclosures.

Who is required to file HR117-1?

Entities or individuals who are subject to the regulations or requirements outlined in the HR117-1 guidelines must file this document.

How to fill out HR117-1?

To fill out HR117-1, you should follow the provided instructions, ensuring that all required fields are accurately completed with the necessary information.

What is the purpose of HR117-1?

The purpose of HR117-1 is to collect specific data that is essential for regulatory oversight, compliance monitoring, or other administrative purposes.

What information must be reported on HR117-1?

HR117-1 requires the reporting of information such as entity details, financial data, and any other relevant information as specified in the filing guidelines.

Fill out your HR117-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hiring Form is not the form you're looking for?Search for another form here.

Keywords relevant to employee new hire forms

Related to forms for new employees to fill out

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.